The use of mean-reversion is pervasive in economics and finance. Much of our use of statistical relationships--or for that matter any inductive inference based on past patterns--in economics and finance is essentially predicated on some loose form of mean-reversion. Yet, time series data also display structural breaks. The always thoughtful Philosophical Economics had a great post about the need for investors to update their beliefs. I am going to take a slightly different tack. Yes, investors need to constantly update their beliefs, but most the problems stem from flawed beliefs rather than changes in structural relationships.

Valuations

Consider CAPE. If I ran any econometric test for a structural break, they would all show that the CAPE series has a structural break sometime in the 1990s. In other words, it has been "different this time" for over two decades. When could you have known with a great degree of confidence that a break occurred? Certainly, by 2005--after all the decline in 2000-02 brought the CAPE barely below the 1960s peak! If you were still not convinced, running break tests in July 2009 would have confirmed it. So, those using CAPE alone as a measuring rod should certainly have been wary.

We can run similar tests with the regular PE or other valuation metrics and the broad conclusions are not very different--sometime in the 1990s there is a structural break.

However, I would argue that the CAPE or the PE are poor candidates for mean reversion. That they seem to bounce around and exhibit some cyclicality does not mean there is a mean which they gravitate toward or there is any time frame in which they should. Theoretically, there is no upward limit to PE. More relevant, the PE is driven by discount factor and growth expectations. We really should be judging if PE adjusted for discount factor and growth expectations shows any structural break.

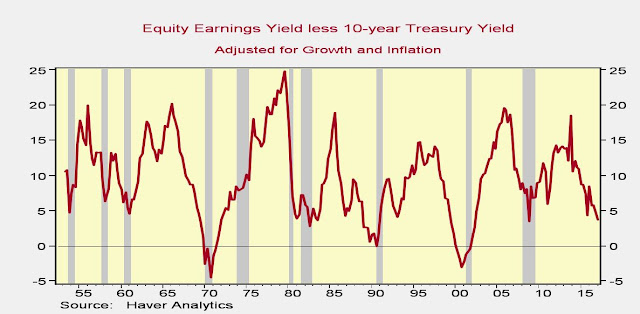

Consider the earnings yield over 10-year Treasury yield adjusted for inflation and growth (the Fed model corrected for its flaws). I have used NIPA earnings and equity market capitalization from the Flow of Funds.

Visually, does this picture suggest any break to you? Contrast with the CAPE picture. Statistically too, the case for break in the 1990s is much less significant.

At the bottom of it, value guys want to believe that there is a bedrock relationship between earnings and valuations. And it appears that there was one for more than 300 years, according to this study. However, the study also suggests that the discount factor has become more dominant in the post WWII era. So, if it is different this time, that time started in 1945!

Profit Margins

There are a lot of misconceptions about profit margins. I would encourage you to read a longer piece I wrote with my colleagues at the Levy Forecasting Center. Briefly,

1. Often, people are looking at the wrong measure of margins--for instance, corporate profits as a share of GDP, when they should be looking at profits earned domestically as a share of GDP. the correct margin (the blue line below) is high but not off the charts.

2. Margins are bounded and cyclical but that does not mean they are mean-reverting. They can remain high for decades.

The bottom line is that mean-reversion based arguments are tricky. Use with caution.

Good points, Srini, about CAPE. The structural break argument is used by Jeremy Grantham in his latest missive for 2Q2017. Yes, margins can remain high and it can be shared unfairly between different stakeholders. In economic terms, this can continue for quite some time provided social costs do not become intolerably high. Perhaps, low interest rates are there to take care of that. So, Dow-36K beckons?

ReplyDeleteA GREAT SPELL CASTER (DR. EMU) THAT HELP ME BRING BACK MY EX GIRLFRIEND.

ReplyDeleteAm so happy to testify about a great spell caster that helped me when all hope was lost for me to unite with my ex-girlfriend that I love so much. I had a girlfriend that love me so much but something terrible happen to our relationship one afternoon when her friend that was always trying to get to me was trying to force me to make love to her just because she was been jealous of her friend that i was dating and on the scene my girlfriend just walk in and she thought we had something special doing together, i tried to explain things to her that her friend always do this whenever she is not with me and i always refuse her but i never told her because i did not want the both of them to be enemies to each other but she never believed me. She broke up with me and I tried times without numbers to make her believe me but she never believed me until one day i heard about the DR. EMU and I emailed him and he replied to me so kindly and helped me get back my lovely relationship that was already gone for two months.

Email him at: Emutemple@gmail.com

Call or Whats-app him: +2347012841542